5 Tips To Prepare for Tax Season in Canada

7Newswire

04 Jan 2023, 21:54 GMT+10

Image Source: Pixabay

As a business owner, one of the constant things you must include in your game plan is your taxes. You have to make sure that you're filing them appropriately. In Canada, the tax return deadline is April 30 of the following year. This means you must file your 2022 tax return by the end of April 2023. Since this date falls on a Sunday, you can file it on May 1, 2023, the next business day.

Although you can't file your taxes this early, now is the perfect time to prepare for it.

Simple Steps for a Smooth Tax Filing

Here are some tips to make your tax filing as smooth as possible.

1. Know your tax type

Tax type refers to the kind of tax your return belongs to. For example, you have income from investments and capital gains. These taxes would likely fall under a capital gains tax return.

If you receive royalty payments in a business partnership agreement, this might be under an investment or trading activity. They will fall under Schedule C/D for self-employed individuals or Schedule D for small businesses.

Tax types also correspond with which province has jurisdiction over laws regarding individual taxpayers.

2. Choose a tax preparation method

You can prepare your taxes in different ways. You can sit with a tax preparer to guide you through the process. They can advise which filing methods are best for your situation, including saving money on taxes.

Suppose time is limited, or you're pressed for cash. In that case, you may use tax filing software approved by the Canada Revenue Agency (CRA).

Finally, and perhaps most importantly, do your tax filing correctly no matter what method you choose. Otherwise, you can lose any potential savings.

3. Prepare your tax records

You will want to keep your records organized and safe. Create a folder or box in which to store your tax documents. This is often called a "tax archive." Make sure it's easily accessible by authorized personnel only.

After this, organize your records. Each year's return should go into one folder, while all other related documents go into another box. If multiple people work together on their taxes, each person will have their own folders. This method makes it easier to find everything needed without having any overlap between individual items from different people.

4. Determine tax credits

The dollar-for-dollar deduction in your tax liabilities refers to your tax credits. They can be non-refundable or refundable, depending on the type of credit you're claiming.

Refundable tax credits reduce your total income taxes and apply to federal and provincial taxes. If you're eligible, these credits will be credited to you. You can receive a series of payments from the federal or provincial government.

5. Claim tax deduction

A tax deduction is a way to reduce your taxable income. It's money you can claim on your federal and provincial returns, but it won't appear in your bank account.

Claiming a tax-deductible is possible if you have an expense eligible for one. This may include payments for vehicle registration fees or property taxes. You'll need receipts for these expenses and the proper documentation to show they were related to work-related activities.

Take the Next Step

After filing your tax return, the next step is the CRA tax assessment. After the tax filing, you will receive the CRA notice of assessment (NOA), an evaluation of your tax return. This will give you all the details you need to know about your tax payments, including payments, refunds, and credits.

Follow these tips and gear up for the coming tax season. Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of North Carolina Daily news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to North Carolina Daily.

More InformationUS

SectionJudge allows Delta to proceed with CrowdStrike lawsuit

ATLANTA, Georgia: A judge in Georgia has ruled that Delta Air Lines can continue most of its lawsuit against the cybersecurity company...

Bipartisan Senate bill targets China, Russia in nuclear energy race

WASHINGTON, D.C.: U.S. senators from both parties introduced a bill this week aimed at countering China and Russia's growing influence...

Tariffs may limit product availability, warns Home Depot

ATLANTA, Georgia: Home Depot plans to hold prices steady despite the added strain of tariffs, the company said, but warned that some...

DOJ drops lawsuit against Southwest over chronic flight delays

WASHINGTON, D.C.: The U.S. Department of Justice dropped a lawsuit last week against Southwest Airlines. The lawsuit, filed near the...

Victims’ families reject tentative Boeing non-prosecution agreement

WASHINGTON, D.C.: Families of some of the 346 people who died in two deadly Boeing 737 MAX crashes plan to oppose a proposed deal between...

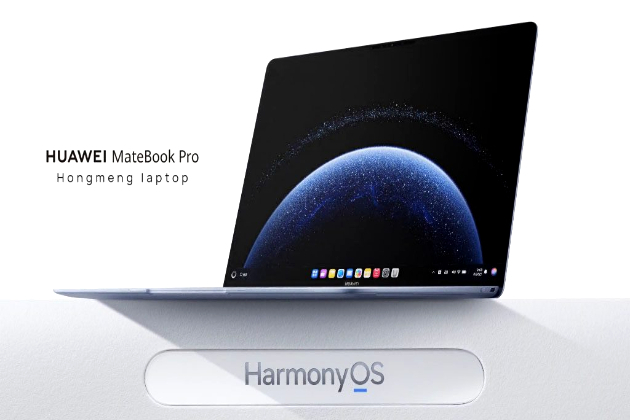

Huawei unveils first HarmonyOS laptops to cut US tech dependence

BEIJING, China: Huawei has launched its first laptops running on its proprietary HarmonyOS, marking a significant step in its effort...