Document Verification Solutions: What Businesses Must Know in 2023

7Newswire

14 Feb 2023, 15:17 GMT+10

In the digital age, crime cases are increasing day by day. Identity theft, money laundering and terrorist financing cases create a huge problem for experts as corporations have to lose millions of dollars. Businesses want to implement innovative digital solutions such as document verification to deter bad actors from exploiting the mainstream system. This way, corporations can follow the latest KYC & AML regulatory obligations.

Document Verification Services: A Quick Insight

Document authentication is a process of validating customers' records such as bank statements, official records and rental agreements. The process is extremely essential in determining the authenticity of given records. A number of businesses use document verification solutions to deter identity fraud, money laundering and terrorism financing cases.

Complete Procedure Behind Document Verification Solutions

How exactly is the work behind document authentication services, this depends upon various factors. For example, the type of industry, and records dealt with in the company. Having said that, there are four steps to record authentication which are below:

The major step in validating documents is to gather the relevant information. There are multiple approaches to achieving the target.

- After submitting the records, the software pre-processes and analyses the information and follows the given business requirements. Is the photo genuine? What about the quality of images? Are there any obvious signs of forgeries within the records? Is there enough information for the validation procedure to complete the process successfully?

If there are records that do not fulfil the given requirements, the system rejects them immediately. This means only the records which are according to the given standards will move on to the next step.

- Whenever a user uploads some records, there is a requirement for a selfie. To access information in the documents, the system must extract the data. For this purpose, the system must capture the desired information by using OCR technology, pattern recognition and other approaches.

After capturing the desired information, the system cross-checks it with pre-existing data to ensure fraud prevention. For example, if a user provides a rental agreement as a Proof of Address (POA), the system will compare the data with pre-existing information and determine its authenticity.

- If there are inconsistencies between the data, it should be considered a red flag. The discrepancies can indicate errors in input data, and point towards fraud cases.

- The next step is important because it plays an important role in determining the authenticity of records. This leads to multiple validation checks and other evaluation parameters. If there is a case of a document being highlighted as suspicious, there are two options for businesses. One option is to completely reject the record whereas the other option is to check the records thoroughly through a manual process. Manual procedures are less effective and safer than digital procedures. But this can play an important role in reducing false negative cases.

Best Advantages of Using the AI-Driven Document Verification Services

Online record authentication offers a number of benefits to the concerned businesses. With the application of the innovative solution, businesses can:

Meet regulatory standards:

Depending on the industry, there can be a requirement by law to validate the identities of customers. The innovative approach is highly effective and widely accepted to fulfil regulatory requirements.

Fight fraud effectively:

There are some jurisdictions where it is not legally required to validate identities. However, if some businesses apply the innovative method, corporations can fight identity theft, money laundering and terrorism financing cases. Moreover, businesses can deter account takeover fraud (ATO).

Win customers' trust:

When businesses implement the verification of documents solution and integrate it with the onboarding procedure. This can help corporations win customers' trust and loyalty. As all the customers go through the same procedure, it is very difficult for criminals to circumvent the defence mechanisms.

Onboard customers faster:

Through automation, the turnaround time for document verification solutions is lesser. This is not the case with traditional procedures as they are extremely time-consuming and waste company resources.

Industries that use online Document Verification Systems

The application of document validation solutions is important for financial institutions and they must verify the identity of all onboarding clients in accordance with AML & KYC regulatory obligations. The following industries must abide by the latest standards:

- Banking service providers

- Credit card Unions

- Thrift Institutions

- Lenders

- Investment firms

- Insurers

- Fintech companies

Concluding Remarks

The application of document verification services can help companies streamline their onboarding procedure and attract genuine customers from around the world. This way, corporations can establish strong relationships with customers and boost overall sales. It not only maintains market credibility but also secures a strategic advantage in a challenging market atmosphere.

Applying a GDPR & PCI DSS-compliant solution can help corporations offer a positive customer experience and increase sales. Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of North Carolina Daily news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to North Carolina Daily.

More InformationUS

SectionNew Mexico opens primaries to nonpartisan voters

SANTA Fe, New Mexico: More and more voters in New Mexico don't belong to any political party. Until now, they couldn't vote in primary...

Trump administration weighs summer military parade in D.C.

WASHINGTON, D.C.: The Trump administration is in early talks about holding a large military parade in Washington, D.C., this summer—a...

Airbus teams up with Amazon to boost in-flight connectivity

HAMBURG, Germany: Airbus is looking to expand in-flight connectivity options through a new satellite partnership with Amazon, as the...

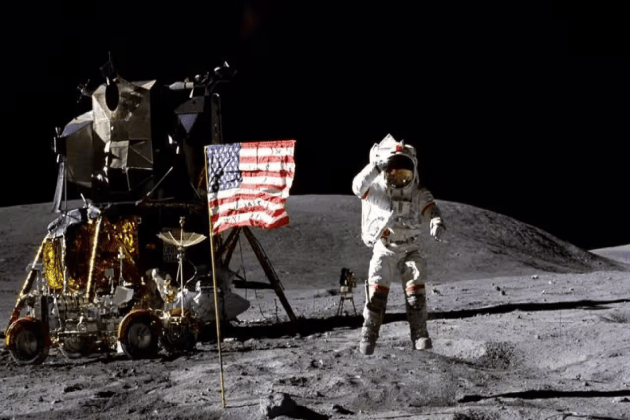

NASA pick backs moon mission as top priority, easing Mars concerns

WASHINGTON, D.C.: U.S. President Donald Trump's choice to lead NASA, Jared Isaacman, has told lawmakers that sending astronauts back...

Thailand shifts trade strategy amid steep US tariffs

BANGKOK, Thailand: Thailand is adjusting its trade strategy in response to unexpectedly steep U.S. tariffs, moving to soften the economic...

Mississippi and Kentucky move toward ending income tax

FRANKFORT/JACKSON: It is been about 45 years since a U.S. state last got rid of its income tax on wages and salaries. But now, Mississippi...