Peakstone Realty Trust Goes Public

7Newswire

25 May 2023, 09:03 GMT+10

In the world of real estate investment trusts (REITs), Peakstone Realty Trust (NYSE: PKST)

has made a mark for itself. Headquartered in El Segundo, California, this NYSE-listed REIT primarily focuses on owning and operating a high-quality, newer-vintage portfolio consisting mainly of single-tenant industrial and office properties. Known as America's Blue-Chip Landlord, Peakstone's mission embodies an ethos of reliability and sustainability.

Peakstone's journey has been noteworthy. The company, formerly known as Griffin Realty Trust, rebranded and transformed into the REIT we recognize today. This transformation has allowed Peakstone to continue to strengthen its portfolio, focusing on industrial and office properties that offer significant value to its shareholders.

One of the exciting chapters in the recent history of Peakstone was its public market IPO. Peakstone Realty Trust's shares, listed on the New York Stock Exchange, showed an impressive rise from $8.00 to $40.45 in just a few days. This dynamic performance demonstrated the financial market's confidence in Peakstone's strategic vision and management.

However, like any business venture, Peakstone's journey has not been without its challenges. The latest Peakstone Realty Trust news is that many investors lost money overall. The REIT recently reported a decrease in rental income, primarily due to the disposition of several properties in 2022 and the first quarter of 2023. Despite this downturn, the company remains focused on its objectives, leveraging its unique approach to property management to maintain strong relationships with tenants and stakeholders.

In summary, Peakstone Realty Trust is more than just a REIT. It's a reflection of America's evolving real estate landscape, where traditional property types intersect with a future-leaning approach to asset management. As Peakstone continues to navigate the complexities of the market, its commitment to owning and operating high-quality properties stands as a testament to its resilience and strategic vision.

While the road ahead may present challenges, Peakstone Realty Trust's story is an inspiring example of how innovation, careful management, and a focus on quality can drive success in the real estate industry. With its firm footing in the real estate market and an unwavering commitment to its shareholders, there's no doubt that Peakstone is positioned to continue making waves in the REIT landscape.

Investing in Real Estate Investment Trusts (REITs) offers both advantages and disadvantages, depending on an individual's financial goals, risk tolerance, and investment horizon. Here are some of the main pros and cons of investing in REITs:

Pros of Investing in REITs:

- Income Generation: REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends. This feature makes them particularly appealing for income-focused investors.

- Liquidity: Unlike direct real estate investments, REITs are traded on major stock exchanges, which means they offer higher liquidity. You can buy or sell shares of a REIT quickly, similar to how you would transact with stocks.

- Diversification: REITs allow investors to own real estate indirectly without the need to buy, manage, or finance properties. Moreover, they provide access to a diversified portfolio of real estate assets, including commercial properties, residential buildings, hospitals, shopping centers, etc., thereby spreading risk.

- Transparency: As publicly-traded entities, REITs are subject to regulations by the Securities and Exchange Commission (SEC), including regular financial disclosures. This transparency allows investors to make informed decisions.

Cons of Investing in REITs:

- Market Risk: Like any investment, REITs are subject to market volatility. The value of a REIT can fluctuate based on the overall health of the stock market, interest rates, and the real estate market itself.

- Interest Rate Sensitivity: REITs are often sensitive to changes in interest rates. When rates rise, the cost of borrowing increases for REITs, which can affect profits. Moreover, higher interest rates can make other fixed-income investments more attractive compared to REITs, putting downward pressure on REIT prices.

- Tax Implications: Although REITs are required to pay high dividends, these dividends are usually taxed as ordinary income rather than at the lower capital gains tax rate. This aspect can lead to higher tax bills for investors who hold REITs in taxable accounts.

- Limited Capital Appreciation: While REITs can provide a steady income stream, they may offer limited capital appreciation compared to other types of equities. The majority of a REIT's total return typically comes from dividends rather than price appreciation.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of North Carolina Daily news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to North Carolina Daily.

More InformationUS

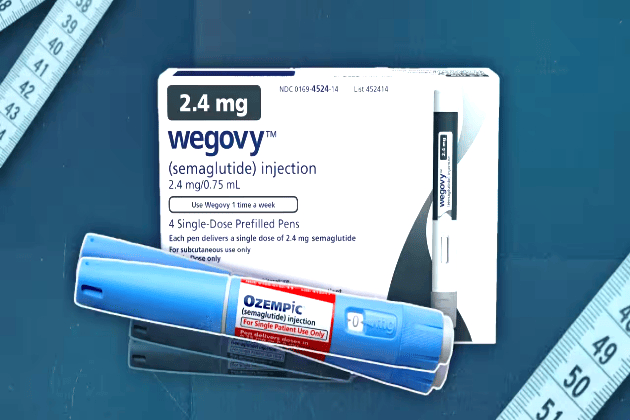

SectionMedicare backs off Biden plan for weight-loss drug coverage

WASHINGTON, D.C.: The Centers for Medicare & Medicaid Services (CMS) says it will not go ahead with a plan from the Biden administration...

IRS begins major layoffs, civil rights office hit first

WASHINGTON, D.C.: The U.S. Internal Revenue Service (IRS) began laying off workers late last week, according to an email sent to staff,...

Nissan eyes manufacturing shift to dodge US Tariffs

TOKYO, Japan: Nissan may soon make a strategic shift in its manufacturing operations, according to a new report from Japan's Nikkei...

Georgia Senate passes bill to ban DEI programs in schools and colleges

ATLANTA, Georgia: Georgia senators ended the 39th day of their 2025 session this week by approving a bill that would ban diversity,...

AlabamIncreasingly, states are attempting to limit or ban the use of phones in schools. Many people worry that phones distract students and that too much screen time and social media can harm mental health.a House moves to ban cellphones in public schools

MONTGOMERY, Alabama: Alabama's House of Representatives has passed a bill that would stop students from using cellphones in public...

Portugal's mega data centre gets multi-billion-euro investment boost

SINES, Portugal: A massive data centre project in Portugal is set to receive a multi-billion-euro boost, as tech giants fuel global...